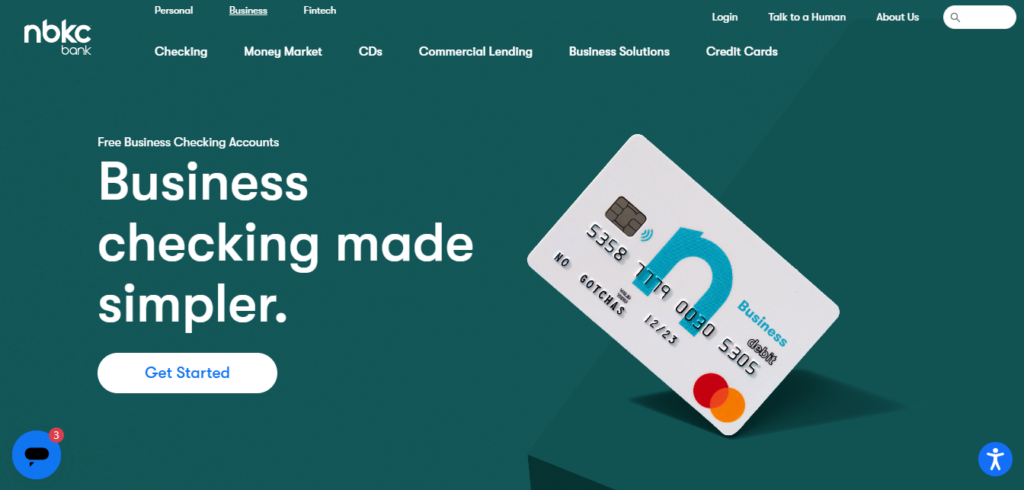

You can build your own NBKC bank account according to your evolving needs as a small business owner or freelancer. This scalable banking solution grows along with your business because of its budget-friendly pricing, customizable add-ons, and personalized services. Take a closer look at the rates, features, pros, cons, and competitors NBKC to discover if it’s a smart choice for you.

Our Verdict

NBKC is an interesting alternative for entrepreneurs like you who want to open a business account that you can tailor to your preferences. First, it’s easy on the pocket because it doesn’t charge you monthly or annual fees for basic banking services.

On top of the freebies, you can also subscribe to a variety of add-ons to expand the functionality of your NBKC bank account. Last but not least, NBKC prides itself on providing customer assistance with a personal touch.

Nevertheless, NBKC has some drawbacks too. To begin with, you won’t automatically get a credit card with your business account, although you will receive a debit card. Also, you won’t gain interest if you choose the checking account, yet you can expect a minimal APY if you select the savings account. Finally, you can contact the support team only from Mondays to Fridays, but not during weekends.

To sum things up, NBKC is a practical business account for you in case you value banking flexibility.

- Cost-effective pricing

- Many extra service options

- In-person assistance available

- No credit card

- Zero APR for business checking account

- Weekday support only

NBKC Bank Account at a Glance

NBKC is an online bank and mortgage lender that offers business and personal accounts. Its goal is to provide simple solutions to make banking accessible to everyone. Founded in 1999, it’s currently based in Kansas City, Missouri. Since 2017, it has gained recognition as the Kansas City Business Journal Best Place to Work.

NBKC has an edge over other banks when it comes to adaptability. Both business checking and savings accounts include built-in features like debit card, check deposits, online banking, Bill Pay, stop payments, incoming domestic wires, security, and customer service. Beyond this, you have the option of selecting additional services to level up your banking experience.

Pricing: Starts at $0/month or year

Who NBKC Bank Account Is Best For

The NBKC bank account is suitable bank for startup entrepreneurs and independent contractors who need a business account they can tweak based on their business development. It already comes with complimentary basic services to get you started on your banking journey. At the same time, you can boost your plan by signing up for extra features as your needs and budget grow over time.

Pricing

NBKC stands out among business bank accounts because of its unique pricing scheme. Unlike other banks that offer different tiers, it only presents you with a single type each of business checking account and business savings account. However, you can customize your account by selecting add-on services.

Take a peek at the chart to find out what’s included in every NBKC bank account:

Accounts

Business Checking Account

Business Money Market Savings Account

Monthly/Annual Fees

$0

$0

Minimum Initial Balance

$0

$0

Minimum Maintaining Balance

$0

- Without APY: $0

- With APY: $0.01

APY

None

0.05%

Debit Card

Free NBKC Business Debit MasterCard

Free NBKC Business Debit MasterCard

Check Deposit

Free via in-branch or NBKC app

Free via in-branch or NBKC app

Online Banking

Free for Android & iOS

Free for Android & iOS

Bill Pay

Free

Free

Stop Payments

Free in-branch or online

Free in-branch or online

Incoming Domestic Wires

Free within the U.S.

Free within the U.S.

Security

FDIC insurance, multi-factor authentication & customer identification program

FDIC insurance, multi-factor authentication & customer identification program

Customer Service

Weekday support via phone, email, or in-person

Weekday support via phone, email, or in-person

Add-ons

Multiple paid extra services

Multiple paid extra services

In short, there is only one type each of NBKC business checking and savings accounts:

Business Checking ($0/month or year): This free business checking account makes it easy for you to issue check payments and perform other business transactions. Aside from having zero monthly or annual fees, there’s no minimum balance required to maintain your account.

If you are interested in opening a fee-free business account, here is a detailed BlueVine Review and Bank of America Review packed with information about the pros, cons, and alternatives to both fintech companies.

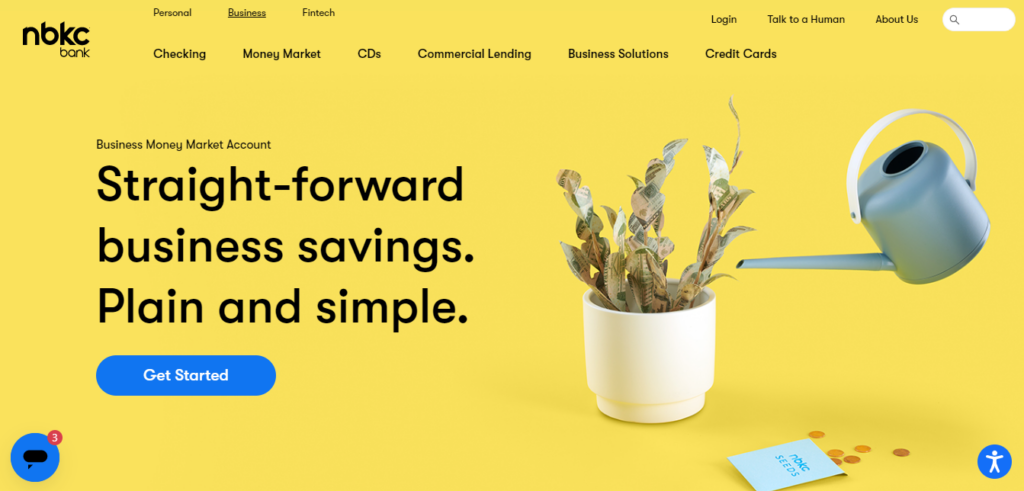

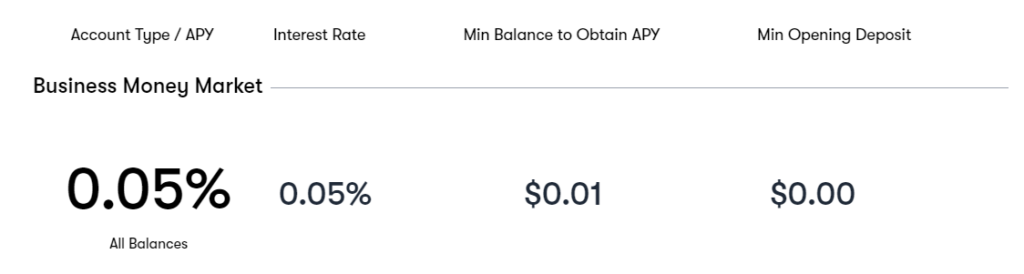

Business Money Market ($0/month or year): This free business savings account lets you safely store and grow your professional funds. Again, you won’t be charged any monthly or annual fees. While there’s technically no minimum maintaining balance, you need to have at least $0.01 in your account to receive APY.

On top of the free services, you can take your pick from paid extra services, which we’ll talk about in the add-ons section.

NBKC Bank Account Features

NBKC business accounts include a free set of essential features, plus paid additional services. Let’s discuss the APY, debit card, check deposits, online banking, Bill Pay, stop payments, incoming domestic wires, security, customer service, and add-ons in this review.

APY

The annual percentage yield (APY) is the interest that you can earn by keeping money in your NBKC bank account. If you open a Business Money Market account, you have the chance to gain a 0.05% APY on your savings funds. You do need to maintain a balance of at least $0.01 to get interest, but this amount is very minimal. However, don’t expect to receive APY at all if you have a Business Checking account.

Debit Card

No matter which business account you choose, you will receive a free NBKC Business Debit MasterCard. This debit card can come in handy if you plan to buy business supplies and equipment in online shops or brick-and-mortar stores that accept MasterCard.

Take note that neither the business checking nor savings bank account will automatically provide you with a credit card. Still, you can apply for a business credit card separately with NBKC.

Check Deposit

You can deposit checks for free, whether you have a business checking or savings account. You can go to a physical branch of NBKC to personally drop off the check. If there aren’t any NBKC locations in your area, you can perform the check deposit online with the help of the NBKC app.

Online Banking

Aside from check deposits, you can conduct different online business banking transactions via the NBKC app. It’s easy to use the app to transfer funds or check your account balance anytime, anywhere.

You can download the NBKC app from the Google Play Store, which means it’s compatible with Android mobile phones and tablets. It’s also available from the Apple app store so you can install it on your iPhone, iPad, or iPad touch.

Bill Pay

NBKC makes it convenient for you to pay your bills in a central way. It allows you to take advantage of Bill Pay on your smartphone, tablet, or computer. Plus, there’s no extra charge to use this online payment service when you have a NBKC business checking or savings account.

Stop Payments

You can make stop payments for free if you have a Business Money Market or Business Checking account. These requests make it possible for you to cancel check payments, as long as the checks haven’t been deposited, cleared, or encashed yet. NBKC gives you the chance to make stop payments online or by visiting a bank branch.

Incoming Domestic Wires

Both NBKC business checking and savings accounts permit you to accept incoming domestic wires for free. You can receive money that’s transferred from someone else’s bank account into your own business account, as long as the sender is located in the U.S.

However, you do need to pay a $5 fee every time you send domestic wires. Also, you will be charged $45 each time you send or receive international wires. This could potentially set you back major bucks if you often transfer money to other people or companies.

Security

NBKC is a member of the Federal Deposit Insurance Corporation (FDIC). This U.S. government agency ensures the safety of the funds which you stored in the bank. That’s why you can rest assured that the deposits in your business checking or savings account are insured up to $250,000.

In addition to this, multi-factor authentication adds extra layers of security to safeguard your account. You will be asked to enter an access code whenever you login or perform high-risk banking transactions. Lastly, the customer identification program verifies the identity of each person who opens an account to minimize the risk of money laundering.

Customer Service

NBKC makes an effort to provide personalized services to all its clients. You can contact the support team through phone or email. Plus, it has an edge over online banks because it gives you the chance to request for banking assistance in person.

Nevertheless, general account support is only available from 8 a.m. to 5 p.m. CST Mondays to Fridays. This could possibly cause inconvenience if you encounter banking issues on weekends. Also, NBKC only has one main office and four brick-and-mortar branches in Missouri and Kansas.

While this is less than the widespread locations of big banks, it’s still better than most online banks which have zero physical locations. At least, you have the option of visiting physical branches if you need face-to-face support, in case you live in one of the two states.

Add-ons

In addition to the built-in features we discussed, there is a wide range of add-ons you can subscribe to if you have a NBKC business checking or savings account. Some examples of extra services are desktop deposits, ACH transactions, extended archives, and business security tools.

Check out the chart below to get an overview of the add-on rates:

Monthly Fee

Annual Fee

Desktop Deposit

$15/month

$150/year

ACH Credits and Debits

$15/month

$150/year

Extended Archive

$15/month

$150/year

Business Fraud Tools

$5/month

$50/year

Alternatives to NBKC Bank Account

NBKC is a viable option for you if you value banking versatility. However, there are other alternatives you may consider if you prefer to focus on other aspects of banking.

Lili is a financial technology company that provides business accounts via its partner bank, Choice Financial Group. It’s suitable for sole proprietors and independent contractors who need extra help in managing their business resources. It’s also considered as one of the best business accounts for LLCs. After all, it comes with a slew of financial management features, which NBKC lacks.

First, the tax optimizer tools make it easy for you to file your taxes and boost tax savings. Next, you can keep track of your expenses through the mobile app. Finally, you may create and edit invoices via the app so you can get paid for your products and services.

Still, NBKC is better than Lili in several ways. It actually has physical locations, in contrast to Lili which offers purely online services. Also, it gives you phone and in-person customer support, while you’re stuck with email support with Lili. Last but not least, the business accounts of NBKC are more adaptable than the Lili accounts, thanks to the add-on options.

Pricing: Starts at $0/month

- Tax filing assistance

- Built-in expense management

- Invoice tool

- No brick-and-mortar branches

- Limited email support only

- Not flexible like NBKC

Novo is a financial tech company that offers business banking services with the help of its partner bank, Middlesex Federal Savings. It’s fitting for startup founders and freelance professionals who need a free business checking account that integrates with third-party platforms.

Unlike NBKC, Novo allows you to connect your bank account to PayPal, Stripe, and Square to increase your payment options. Plus, you will receive both virtual and physical debit cards, while NBKC only issues you a physical card. To top things off, you can send ACHs for free, in contrast to NBKC which charges for ACH transactions.

Nevertheless, NBKC is superior to Novo in other ways. For example, it grants you the option of a business savings account, which isn’t available with Novo. Aside from this, you can drop by NBKC brick-and-mortar branches in Kansas and Missouri, while it’s not possible to do so with Novo. Finally, NBKC allows you to apply for a credit card separately, unlike Novo which doesn’t have credit card offerings at all.

Pricing: Starts at $0/month

- Third-party integrations

- Virtual debit card

- Free outgoing ACH

- Savings account unavailable

- Zero physical locations

- No credit card

Kabbage is a financial technology company powered by American Express that specializes in business funding. It’s appropriate for entrepreneurs who need a free checking account, plus loans which equip them to develop their business.

On one hand, Kabbage gives you the opportunity to apply for a line of credit, which NBKC doesn’t offer. In addition to this, you can earn a 1.10% APY by maintaining a business checking account, while NBKC only provides APY with the savings account.

On the other hand, NBKC does have certain advantages over Kabbage. One of these is the ability to perform banking transactions in person, although you can make cash deposits via ATM with Kabbage. Plus, you can take your pick between a checking or savings account with NBKC, while Kabbage only provides a checking account. On top of this, you have more leeway to tweak your NBKC business account through extra services, which isn’t the case with Kabbage.

What Kabbage and NBKC do have in common is that you don’t have to worry about monthly maintenance fees if you open a business checking account with either one.

Pricing: Starts at $0/month

- Credit lines

- 1.10% APY for checking account

- Zero monthly charges

- No brick-and-mortar branches

- No savings account

- Less versatile than NBKC

Frequently Asked Questions (FAQs) for NBKC Bank Account

NBKC may not be as well-known as big banks, but its flexibility makes it worth taking a closer look at. Learn the answers to basic questions about NBKC and business banking so you can be prepared to open a business bank account.

Bottom Line on NBKC Bank Account

NBKC gives you the freedom to customize your business banking account to match the growth of your business. It stands out among online banks because of its scalable add-ons, affordable pricing, and solid customer support.

Now that you’ve read this NBKC bank account review, it’s up to you to decide if it’s the ideal banking solution for you as a small business owner or freelancer. Don’t forget to visit also our detailed Chase Bank Review and US Bank Review that might be really helpful for choosing the right bank.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.