Yes, any capital gains you make from cryptocurrencies are taxable. As the U.S. Treasury calls for stricter crypto tax compliance, the IRS is coming after crypto tax dodgers. It’s crucial for investors to know their IRS cryptocurrency tax rate, how to file crypto taxes, and how to legally minimize their tax liability.

What is Your IRS Cryptocurrency Tax Rate?

According to the IRS Notice 2014-2021, cryptocurrency is classified as a digital asset, or in other words, property. Just like owning any other capital asset like stocks, bonds, or real estate, your crypto assets are liable to a capital gains tax. This means buying and holding crypto is not taxable. Only the gains you make from using, selling, or trading cryptocurrency are taxed by the IRS.

The exact cryptocurrency tax rate you need to pay depends on your annual earnings and the time period you held the cryptocurrency. For starters, the capital gains tax on your crypto can either be

- a short-term capital gains tax from 10% to 37% (on crypto assets held for less than one year) or

- a long-term capital gains tax from 0% to 20% (on crypto assets held for more than one year)

Note that evaluating the holding period is an important step in calculating your crypto tax rate. The IRS states that it begins on the next day after you acquire a cryptocurrency and ends on the day you dispose of it. Based on this, if you hold an asset for 365 days or less, it qualifies for a short-term capital gains tax. If the holding period exceeds 365 days, the long-term tax bracket will apply.

Apart from using, selling, or trading crypto, taxes also apply to crypto mining, staking, and getting paid in crypto. This is when you’re receiving an income in crypto and you’re taxed at your regular federal and state income tax rate as far as mining, staking and crypto payment are concerned. Crypto donations, gifts, or inheritance are also taxed but different rules apply to them. More on that below.

When Do You Need to Pay Crypto Taxes?

Before we get to calculating the exact cryptocurrency tax rate that applies to you, let’s categorize different events for simplicity. This way you can tell which events are nontaxable, taxable as capital gains, taxable as income, and are special cases that have special rules and regulations.

Rule out non-taxable events first to get them out of the way.

Nontaxable Cryptocurrency Transactions

You don’t need to pay any taxes if you:

- Purchase and hold cryptocurrency: Simply buying and holding an asset is not taxable. You only incur a tax when you sell, trade, or use it at a higher value than what you purchased it at.

- Donate crypto to a charity or non-profit organization: If you decide to donate crypto to a 501(c)(3) non-profit organization, you can claim a charitable tax deduction.

- Making a crypto gift: If you make a crypto gift under $15,000 per person per year, you do not incur a gift tax.

- Receiving cryptocurrency as a gift: You don’t have to pay any taxes on gifts you receive as long as you don’t sell, trade, or use them.

- Transferring crypto assets between wallets and accounts you own: Circulation of crypto assets between different crypto wallets, or accounts on crypto exchanges does not incur a tax liability.

Cryptocurrency Transactions Taxable as Capital Gains

Note that the capital gains tax only applies when you sell, trade, or use crypto at a higher value than your initial investment. In other words, if the fair market value of a crypto asset increases in your custody, you are liable to pay capital gains tax. The tax applies depending on your annual income and holding period if you

- Sell cryptocurrency for fiat: If you purchased $5,000 worth of a fast-growing cryptocurrency such as Bitcoin in 2018 and sold it for $10,000 in 2021, you make a long-term capital gain. The long-term capital gains tax will apply to the amount of $5,000 that you gained as a result of your investment.

- Make a crypto-to-crypto exchange: Suppose you buy $1,000 worth of Ethereum today and the value of the virtual currency increases over the next few weeks, taking the total value of your holdings to $1,100. If you exchange your ETH for another token, you will be liable to pay a short-term capital gains tax on the $100 you gained.

- Spend cryptocurrency to make a purchase: Suppose you buy $200 worth of a virtual currency and its value doubles in six months. You now have a total crypto holding of $400 and if you spend it to buy a good or service, you will have to pay short-term gains tax on the $200 you gained.

Cryptocurrency Transactions Taxable as Income

You’ll have to pay income tax on cryptocurrency according to your income tax bracket if you:

- Get paid in crypto: Various employers are paying their employees using virtual currencies. This also applies if you sell a service or goods in exchange for crypto.

- Mine crypto: Crypto mining is an activity where miners use powerful computers to solve computational problems that strengthen the blockchain and earn cryptocurrency as a reward. The value of the crypto you earn from mining qualifies to be your income and is taxed as such.

- Stake crypto: Crypto staking is a lot like mining where you hold your crypto assets for a set amount of time to earn staking rewards on it.

- Receive crypto as a result of a hard fork: The assets you get from a hard fork are taxable depending on how you choose to use them once they’re available to you.

- Receive crypto from an airdrop: Airdrops are gifts or rewards you may receive from a company as part of a promotion. Any crypto received as an airdrop is taxable as income.

- Earn crypto as an incentive or reward: There are many other instances where you may receive cryptocurrency as an incentive, or reward that can’t be covered in this list. All such receipts are accounted for as income when calculating your cryptocurrency taxes.

How to Calculate Your Total Cryptocurrency Tax?

Now that you know which of your crypto assets are taxable and what tax applies to them, it’s time to find out the exact tax rates that apply to these assets. Let’s see what the short-term and long-term capital gains tax rates are.

Short-Term Capital Gains Cryptocurrency Tax Rate

Suppose you’ve acquired a digital asset less than a year ago and decide to sell, exchange, or use it. If the market price you sell that asset at is higher than what you bought it at, the profit you make is a short-term capital gain.

Short-term capital gains on cryptocurrency are taxed just like regular income. The tax bracket you fall in depends on your total annual income and filing status. The cryptocurrency tax rate ranges from 10% to 37% on short-term capital gains. If you’ve held the digital currency for 365 days or less, the following tax rates apply.

Tax Rates for Short-Term Capital Gains on Cryptocurrency 2022

Tax rate

Single filer

Married filing jointly

Married filing separately

Head of household

10%

Up to $10,275

Up to $20,550

Up to $10,275

Up to $14,650

12%

$10,276 to $41,775

$20,551 to $83,550

$10,276 to $41,775

$14,651 to $55,900

22%

$41,776 to $89,075

$83,551 to $178,150

$41,776 to $89,075

$55,901 to $89,050

24%

$89,076 to $170,050

$178,151 to $340,100

$89,076 to $170,050

$89,051 to $170,050

32%

$170,051 to $215,950

$340,101 to $431,900

$170,051 to $215,950

$170,051 to $215,950

35%

$215,951 to $539,900

$431,901 to $647,850

$215,951 to $323,925

$215,951 to $539,900

37%

Over $539,900

Over $647,850

Over $323,925

Over $539,900

The short-term capital gains tax is fairly simple to calculate. All you have to do is calculate the total tax owed on cryptocurrency according to your total annual income and filing status. If you’re married and filing jointly and you earn $100,000 per annum, the tax rate that applies to you is 22%. So if your total short-term capital gains on crypto amount to $1,000, you will pay $220 in tax.

Long-Term Capital Gains Cryptocurrency Tax Rate

If you hold a digital currency for more than 365 days and its value increases over the time you’ve held it, then this holding qualifies for a long-term capital gains tax. This tax is lower than its short-term counterpart. You are taxed at 0%, 15%, or 20% on your total profit depending on your total annual income and filing status.

Tax Rates for Long-Term Capital Gains on Cryptocurrency 2023

Tax rate

Single filer

Married filing jointly

Married filing separately

Head of household

0%

Up to $41,675

Up to $83,350

Up to $41,675

Up to $55,800

15%

$41,676 to $459,750

$83,351 to $517,200

$41,676 to $258,600

$55,801 to $488,500

20%

Over $459,750

Over $517,200

Over $258,600

Over $488,500

Let’s say you’re single and earn less than $41,675 a year. If you had bought a cryptocurrency for $1,000 two years ago and now you’ve sold it for $3,000, your capital gain is $2,000. However, you won’t have to pay any capital gains tax as you fall under the first bracket which has 0% tax. But if your yearly earnings are above $41,675, you’ll have to pay 15% on your crypto profit, which, in this case, is $300.

Cryptocurrency Income Tax

We’ve covered the tax rates for both short and long-term cryptocurrency capital gains. Let’s see what tax rate applies to you on the income you earn through cryptocurrency. Remember that these rates apply if you get paid in, mine, stake, or receive crypto as an incentive or reward.

The cryptocurrency income tax rate is the same as regular income tax. You can use the same tax rate table for short-term capital gains to calculate the total tax on your income from crypto.

How to File Cryptocurrency Taxes?

Not everything about trading crypto is interesting. Things can get really boring when you have to report due taxes. Fret not because this step-by-step guide will help you file crypto taxes professionally and effortlessly.

Step 1: Keep Track of All Crypto Transactions

The best practice is to start compiling all your transactions from the very beginning of the tax year. Waiting for the very last moment to start your tax filing preparation can be very taxing. If you’re trading crypto, the crypto exchange you use should have a record of all the transactions you make over a period of time.

But apart from that you also need to compile any instances where you used virtual currencies to purchase a good or service or any transaction that’s not recorded on the exchange. Having a comprehensive record of all crypto transactions at the end of every month can do you a huge service.

Step 2: Calculate Net Capital Gain

As mentioned above, not all crypto transactions are taxable. So you’ll need to filter out nontaxable events and make your tax calculations easier. Once this is done, you can move on to calculating your total tax owed.

This may sound simple but things can get very complicated once you get down to the nitty-gritty. This is why we recommend you use crypto tax software. Crypto tax solutions such as Koinly make transaction reconciliation as easy as it gets and helps you calculate your total capital gains with ease. This is especially useful for you if you’re a professional crypto trader and want your tax filing to be accurate and effortless.

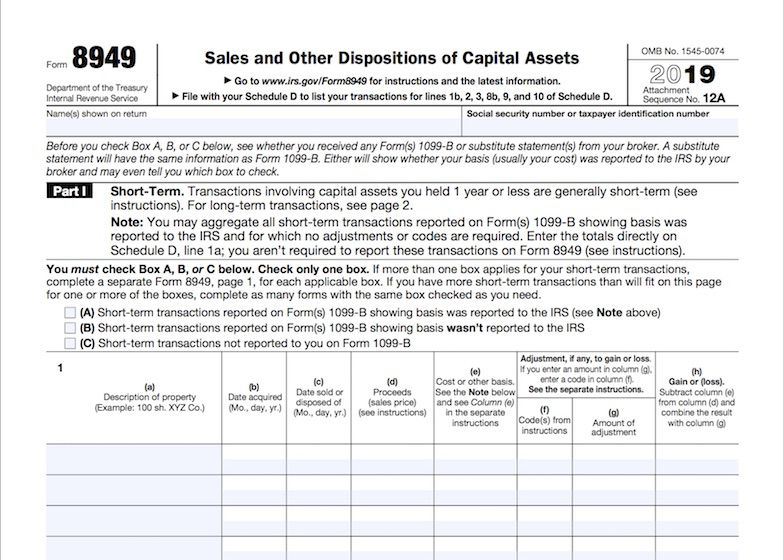

Step 3: Complete the Appropriate IRS Forms

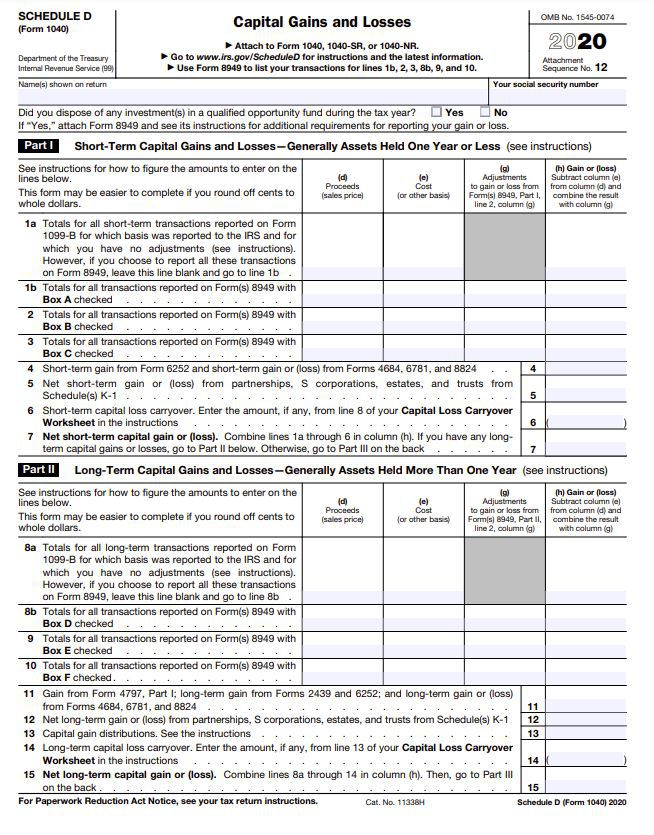

With the net capital gains and income from cryptocurrency calculated, the next step is to fill in the right tax forms. In this case, it would be IRS Form 8949 which is used for reporting the sale and disposal of all capital assets.

Next, you need to tally the summary from your Form 8949 to Form 1040 where you enter your total capital gains or deductible capital losses. This form is also known as the Schedule D.

Step 4: Report Crypto Income

With crypto capital gains out of the way, you’re left with your cryptocurrency income to report. Depending on what type of income it is, there are a few different types of forms you’d need to fill.

Income from airdrops, forks, or trading crypto as a hobby is reported on Schedule 1 as other income. Mining, staking income, or any other interest rewards from lending or holding your cryptocurrency is reported on Schedule B.

Lastly, if you’ve earned crypto through a business, which includes receiving payments for goods and services in crypto or running a mining farm, this would be treated as self-employment income. This type of income is reported on Schedule C.

Step 5: Submit Tax Returns to the IRS

Once all your forms are complete, the last step is to submit them to the IRS and make sure they’re filed on time. We recommend that you use tax filing software for this purpose to ensure everything goes well.

How to Minimize Crypto Taxes?

Crypto taxes can incur a huge dent in your finances, especially if most of your gains are in the short term. We’ve researched a handful of legal and powerful strategies to minimize your crypto taxes.

Tax-Loss Harvesting

Note that you are only taxed on your net capital gains. This means any losses that you incur from selling, using, or trading a crypto asset can be used to offset the profits. But both the profits and losses need to be ‘realized’ for them to be accounted for.

This means if you bought BTC worth $5,000 and it depreciated down to $4,000, you cannot harvest the loss of $1,000 until you sell, use, or trade the asset. In other words, you need to realize any potential losses to use them to offset gains in your tax bill.

It’s also important to note that the maximum amount of capital losses you can report in a tax year is $3,000. Losses of values greater than this can be moved on to subsequent years.

Convert Short-Term Capital Gains into Long-Term Ones

Long-term capital gains taxes are lower than short-term ones. You can significantly reduce your tax liability if you choose to hold an asset for more than a year. Develop a long-term investment strategy to minimize your taxes in this way. Experts recommend investing in a deflationary cryptocurrency if you’re going in for the long term.

Gift or Donate Crypto

Donations in cryptocurrency are not taxed as long as you’re donating to a certified charitable or nonprofit organization. Gifts are also not taxed as long as you don’t gift more than $15,000 per person per year.

Frequently Asked Questions (FAQs) for Cryptocurrency Tax Rate

Here are some of the most frequent questions people ask about crypto taxes. This section will help you resolve any questions you may have about different aspects of crypto taxation.

Bottom Line on Cryptocurrency Tax Rate

Cryptocurrency is taxed just like any other capital asset. Remember that you are liable to pay taxes only on a taxable event which generally includes selling, trading, or using cryptocurrency for purchasing. The short-term and long-term capital gains tax rate ranges from 10% to 37% and 0% to 20% respectively.

Any income you earn in the form of digital currency is also taxed like regular income. Calculating and filing crypto taxes can be complicated, especially if you’re filing at the last moment. We recommend you use crypto tax software Koinly to calculate and file tax returns efficiently.